- Indonesia’s insurance literacy index in 2016 stood at only 15.76% - OJK 2017

- Sun Life Financial Indonesia's #LebihBaik Sekarang (Better Now) communications campaign encourages the Indonesian public not to delay any longer in carrying out proper financial planning, in order to achieve financial security

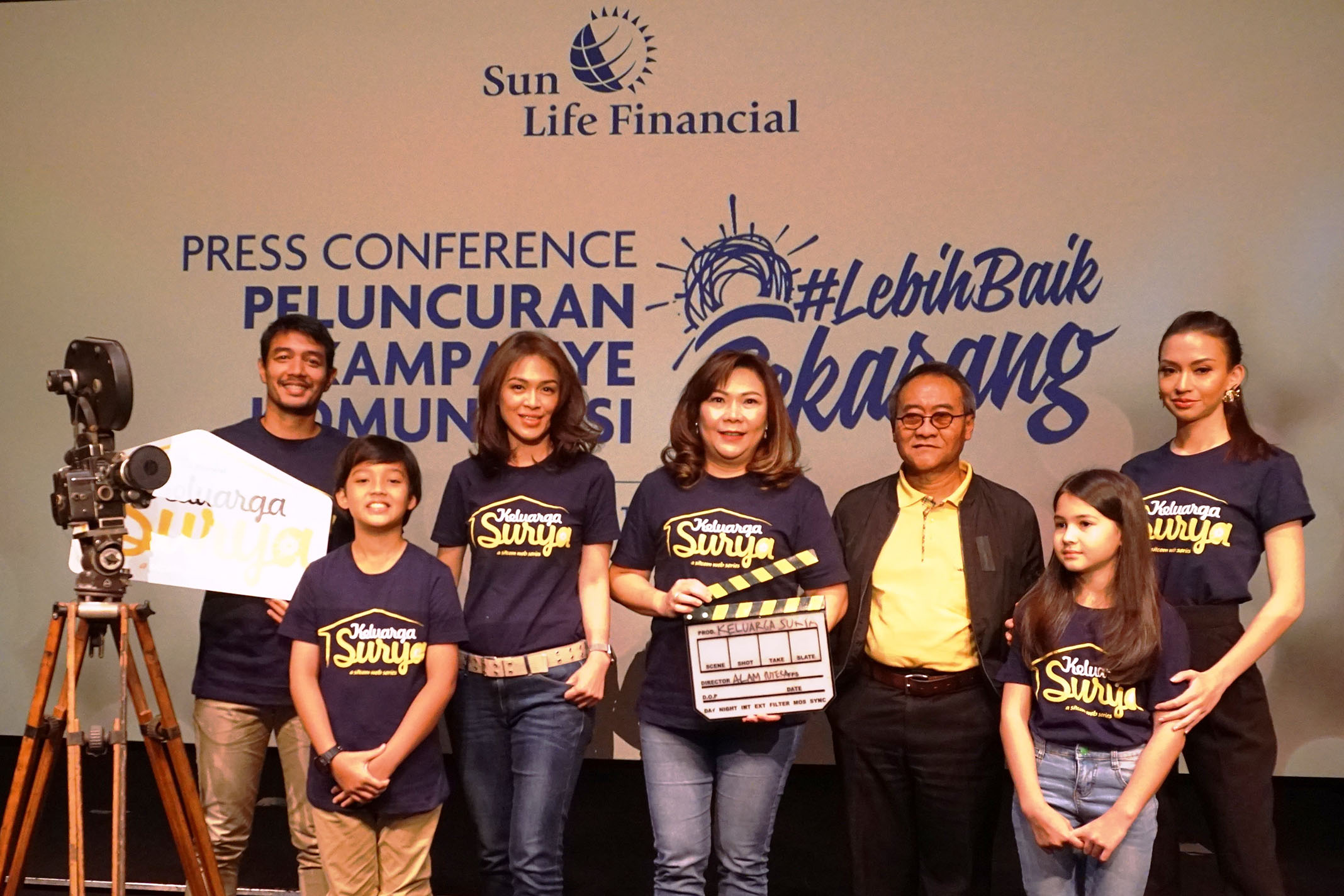

- Sun Life Financial Indonesia launches a video web series titled 'Keluarga Surya', with the first episode about the Lebaran Holiday Allowance (THR)

JAKARTA, 31 May 2018 – Obtaining the highest level of education, getting the best health care, and achieving financial security are the dreams of everyone, whether for yourself or your family. Unfortunately, there are still many people who do not have an understanding of financial management, especially when it comes to protection and investments. As such, they choose to delay performing their financial planning which could ensure their future comfort.

Data from the Financial Services Authority (OJK) in 2017 revealed that the insurance literacy index in Indonesia remains the biggest challenge for the country's life insurance industry. The National Literacy and Financial Inclusion Survey (SNLIK) conducted by the OJK in 2016 showed that the number of Indonesian people who have a good 'literacy' level with respect to the insurance industry is relatively low. In fact, the insurance literacy index stood at a mere 15.76%, down from the figure in the corresponding survey in 2013 of 17.84%. Meanwhile, the utility rate stood at 12.08%, almost unchanged from the 2013 survey's figure of 11.81%. That is, out of every 100 Indonesian people only 15 to 16 of them know an insurance financial services institution and only 12 actually utilize insurance services. This situation prompted PT Sun Life Financial Indonesia ("Sun Life") to continue actively educating the public, in particular Indonesian families, on the importance of attaining financial security. One of the ways Sun Life is doing this is through the #LebihBaik Sekarang (Better Now) communication campaign which was officially launched today.

“Over 23 years of operating in Indonesia, Sun Life has assisted numerous Indonesian families to make their future aspirations come true. Of course, we would also like more and more people to benefit from careful financial planning in order to achieve financial security. Through the #LebihBaik Sekarang campaign, Sun Life is appealing for Indonesians to no longer delay in conducting proper planning so that they can gain better quality health, education and finance for themselves and their families,” said Elin Waty, President Director of Sun Life Financial Indonesia.

Armed with long experience and unrivalled competence in the insurance and financial industries, Sun Life understands that financial literacy and financial management are essential for every Indonesian family, especially considering that the family is one of the pillars of the nation's economy. In addition, as the smallest unit of society, the family plays an important role in introducing and instilling good values in individuals. One of these values relates to financial management and planning.

Prof. Dr. Paulus Wirutomo, M. Sc, Sociology and lecturer in Sociology at the University of Indonesia, explained, “The values embraced by an individual have an important role in the person's decision making, including when conducting financial planning. The value system adopted by an individual will determine his or her attitude and behavior towards certain things, not least in financial planning. The influence of culture, religion, and environment is also a factor in the formation of a value system within a person. As the social environment in which an individual is first immersed, the family environment is where values are first imparted. With regard to financial management, the attitudes and behaviors of the current generation have not moved far from those of previous generations despite a shift in the allocation and purpose of financial planning itself.” Comparing the current generation with previous generations, young families today tend to enjoy saving for short-term purposes and are reluctant to invest long-term1. The fact is, however, that by understanding and starting to undertake the right financial management, this generation can still enjoy their current lifestyle without neglecting their future comfort of life.

“Recognizing the need to make continuous efforts in providing financial-related education has spurred us on to think creatively and adapt to this era in which it is vital to provide an adequate financial understanding to the wider community, especially to the younger generations and families of Indonesia. That's why we are presenting a video web series called 'Keluarga Surya' as a means of offering education about financial literacy that is easily accessible to the public in the form of digital visual content which uses the sitcom genre to convey its meaning,” Shierly Ge, Chief Marketing Officer Sun Life Financial Indonesia, pointed out.

This video web series tells the story of the life of a modern family with a variety of daily issues, including the management of their Holiday Allowance (THR), family education planning, and the importance of leading a healthy lifestyle. Through each of the Keluarga Surya stories, which take place in an episode of about 5 minutes, Sun Life is eager to deliver a message to young Indonesian families about the importance of financial planning, the importance of a healthy lifestyle, and the importance of setting good strategies for the future. The roles are played by talented young actors and actresses such as Edo Borne as Ayah Surya, Karina Nadila as Ibu Mentari, Bima Azriel as Fajar and Sandrinna Michelle as Cahaya. The series of ‘Keluarga Surya’ stories can be viewed on Sun Life Financial Indonesia's official YouTube channel (Sun Life Financial ID).

“We hope that through the #LebihBaik Sekarang campaign, as well as the content of the message delivered through the video web series ‘Keluarga Surya’, an ever greater number of people will be moved to start financial planning from an early age, so that eventually a smart, financially well-established and also healthier Indonesian society is formed,” Elin said in closing.

1 2016 ORC International Survey

- 00 -

About Sun Life Financial Indonesia

Sun Life Financial Indonesia is a wholly owned subsidiary of Sun Life Financial. We offer a wide range of protection and management through varied products, including life insurance, educational insurance, health insurance, and retirement plans. Sun Life partners with leading financial institutions, both nationally and internationally, to provide multi-distribution channel strategies while also providing extensive access to our insurance solutions.

Sun Life Financial Indonesia won several prestigious awards in 2017 including:

1. PT Sun Life Financial Indonesia won the award as the Best Takaful Family Provider Indonesia 2017 at the Global Banking & Finance Awards 2017 held by Global Business Outlook

2. PT Sun Life Financial Indonesia was presented with the Excellent Service Experience Award (ESEA) 2017 for the category of Life & Health Insurance held by the Carre Center for Customer Satisfaction and Loyalty (“Carre CCSL”) and Service Excellence Magazine.

3. PT Sun Life Financial Indonesia received the award for Predikat Bintang Lima atas Kinerja Unit Link Jenis Campuran tahun 2012 – 2016 untuk Salam Balanced Fund (Five Star Performance for Mixed Unit Link Products 2012 – 2016 for the Salam Balanced Fund) at the 2017 Unit Link Awards 2017 from Infobank Magazine.

4. PT Sun Life Financial Indonesia won the award as HR Asia Best Company to Work for in Asia 2017 Awards from HR Asia Media International.

5. PT Sun Life Financial Indonesia received the award as Indonesia’s Most Admired Company – Special Mention Life Insurance from Warta Ekonomi Magazine.

6. PT Sun Life Financial Indonesia won the award as HRD Employer of Choice as the Top Performer award in the category of Learning & Development.

7. PT Sun Life Financial Indonesia won the award for Best Financial Performance Life Insurance Company for the category of Assets between IDR 6-10 trillion in the Indonesia Insurance Consumer Choice Awards 2017 from Warta Ekonomi Magazine.

8. PT Sun Life Financial Indonesia received the award for Best e-Mark Award 2017 as The 1st winner Category Life Insurance Company in Indonesia from SWA Magazine.

9. PT Sun Life Financial Indonesia won the award for Special Mention as The Innovative CEO in Insurance Sector in the Most Admired CEO 2017 from Warta Ekonomi Magazine.

10. PT Sun Life Financial Indonesia won the award as The Most Popular Company – Category Life Insurance from Warta Ekonomi Magazine

11. PT Sun Life Financial Indonesia won the award as The Most Informative Insurance Company Campaign from Warta Ekonomi Magazine

About Sun Life Financial

Sun Life Financial is a leading international financial services provider offering a wide range of insurance products, as well as asset and wealth management solutions for both individuals and corporations. Sun Life Financial has operations in a number of major markets around the world such as Canada, the USA, the UK, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of March 31, 2018, Sun Life Financial had total assets under management amounting to CDN 979 billion. For more information, please visit www.sunlife.com.

Sun Life Financial Inc. is traded on the Toronto Stock Exchange (TSX), New York Stock Exchange (NYSE), and the Philippines Stock Exchange (PSE), with the stock symbol SLF.

For more information, please contact:

Shierly Ge

Chief Marketing Officer

Sun Life Financial Indonesia

Tel: +6221-5289-0000

Faks: +6221 5289-0019

E-mail: shierly.ge@sunlife.com