Premium payment can be done through:

1. Pembayaran dengan Virtual Account (VA)

- Khusus pembelian polis asuransi melalui Agen yang polis terbit setelah 14 Maret 2022

Nomor Rekening VA untuk pembayaran premi adalah Kode Sun Life + Nomor Polis

Premium payment can be done through:

1. Pembayaran dengan Virtual Account (VA)

Nomor Rekening VA untuk pembayaran premi adalah Kode Sun Life + Nomor Polis

| Bank | Kode Sun Life | Nomor Rekening VA | Kode Bank jika transfer dari bank lain | Nama Penerima Dana |

|---|---|---|---|---|

| (Contoh Nomor Polis: 123456789) | ||||

| BCA | 00927 |

00927123456789 | Hanya bisa transfer melalui Bank BCA | Nama Pemilik Polis |

| BNI | 8511000 | 8511000123456789 | 009 | Nama Pemilik Polis |

| CIMB Niaga | 2579 | 2579123456789 | 022 | Nama Pemilik Polis |

| Mandiri | 88126 | 88126123456789 | 008 | Nama Pemilik Polis |

| BRI | 14055 | 14055123456789 | 002 | Nama Pemilik Polis |

| BSI | 9288600 | 9288600123456789 | 451 | Nama Pemilik Polis |

Pembayaran Premi harus dilakukan sesuai dengan jumlah tagihan, pembayaran premi yang dilakukan tidak sesuai tagihan akan menyebabkan gagal proses pembayaran.

| Bank | Kode Sun Life | Nomor Rekening VA | Kode Bank jika transfer dari bank lain | Nama Penerima Dana |

|---|---|---|---|---|

| (Contoh Nomor Polis: 123456789) | ||||

| BCA | 00927 |

00927123456789 | Hanya bisa transfer melalui Bank BCA | Nama Pemilik Polis |

| BNI | 8511000 | 8511000123456789 | 009 | Nama Pemilik Polis |

| CIMB Niaga | 8599 | 8599123456789 | 022 | Nama Pemilik Polis |

| Mandiri | 88669 | 88669123456789 | 008 | Nama Pemilik Polis |

| BRI | 22786 | 22786123456789 | 002 | Nama Pemilik Polis |

| BSI | 9288600 | 9288600123456789 | 451 | Nama Pemilik Polis |

| Bank | Kode Sun Life | Nomor Rekening VA | Kode Bank jika transfer dari bank lain | Nama Penerima Dana |

|---|---|---|---|---|

| (Contoh Nomor Polis: 123456789) | ||||

| CIMB Niaga | 3439 | 3439123456789 | 022 | Nama Pemilik Polis |

Keterangan:

- Fasilitas Virtual Account BCA hanya diperuntukkan bagi nasabah yang mempunyai rekening BCA

- Untuk nomor polis yang diawali dengan huruf "MS", maka mohon untuk mengubah huruf "MS" tersebut menjadi angka 77

2. Pembayaran dengan kartu kredit

Pembayaran dengan kartu kredit dapat dilakukan dengan menghubungi Pusat Layanan Nasabah PT Sun Life Financial Indonesia, setiap hari kerja (kecali hari libur nasional) melalui layanan berikut ini:

Pembayaran dilakukan melalui link yang akan dikirimkan ke alamat email dengan memasukkan informasi kartu kredit yang dibutuhkan.

Catatan: Pembayaran Top Up tidak diperkenankan menggunakan kartu kredit

3. Pembayaran khusus Polis Asuransi mata uang Dollar

| Nama Bank | Nomor Rekening | Nama Pemilik Rekening |

| Mandiri | 102-000-691-8699 | PT Sun Life Financial Indonesia |

| BCA | 319 -3078- 687 | PT Sun Life Financial Indonesia |

4. Alfamart

5. BRILink

6. Multiple payment

Multiple payment is an option for clients who have been using auto debit since the beginning, but experiencing obstacles:

In order to maintain the validity of policy, clients can pay the overdue premium via transfer to Virtual Account number or paying at Alfamart.

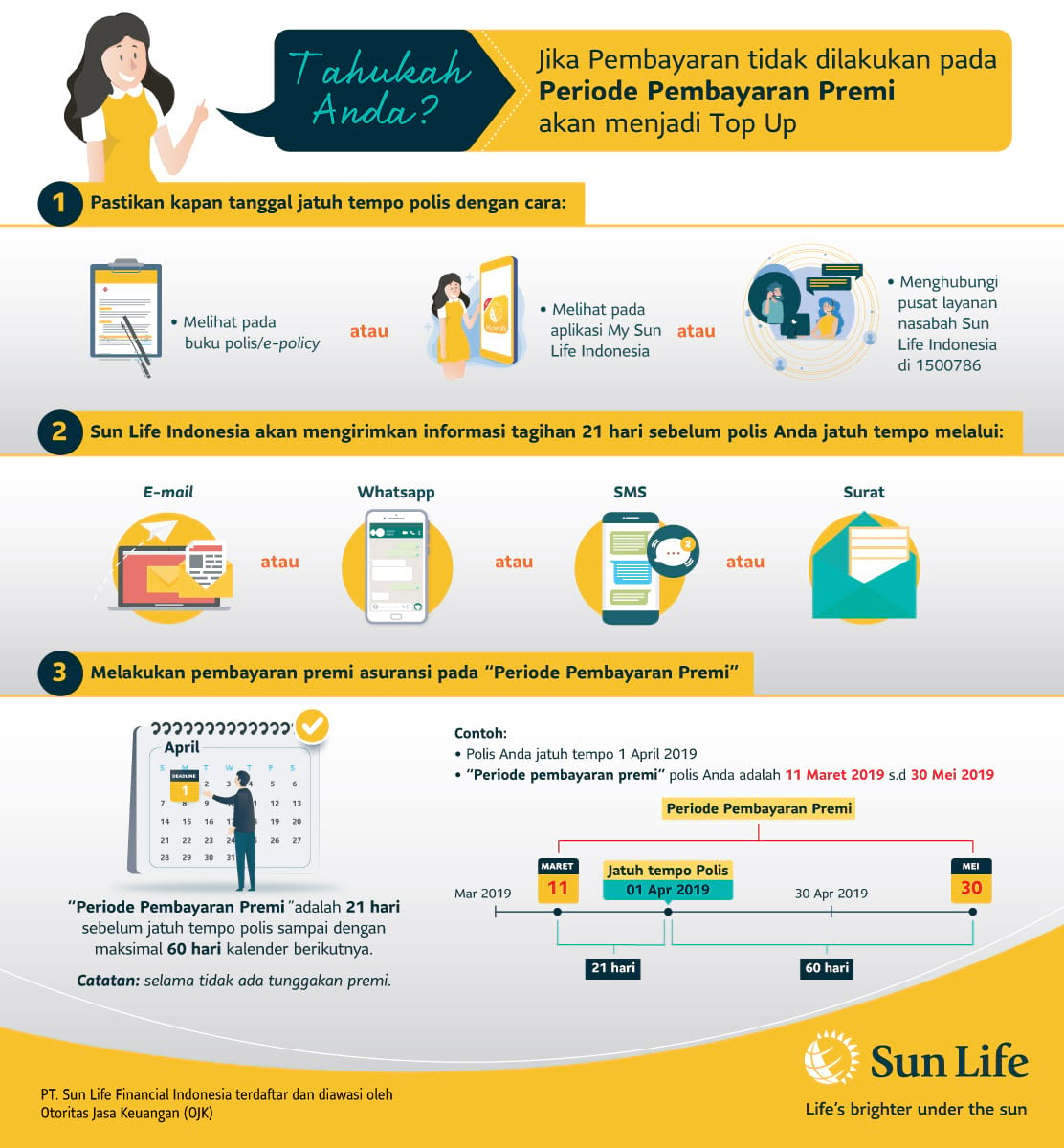

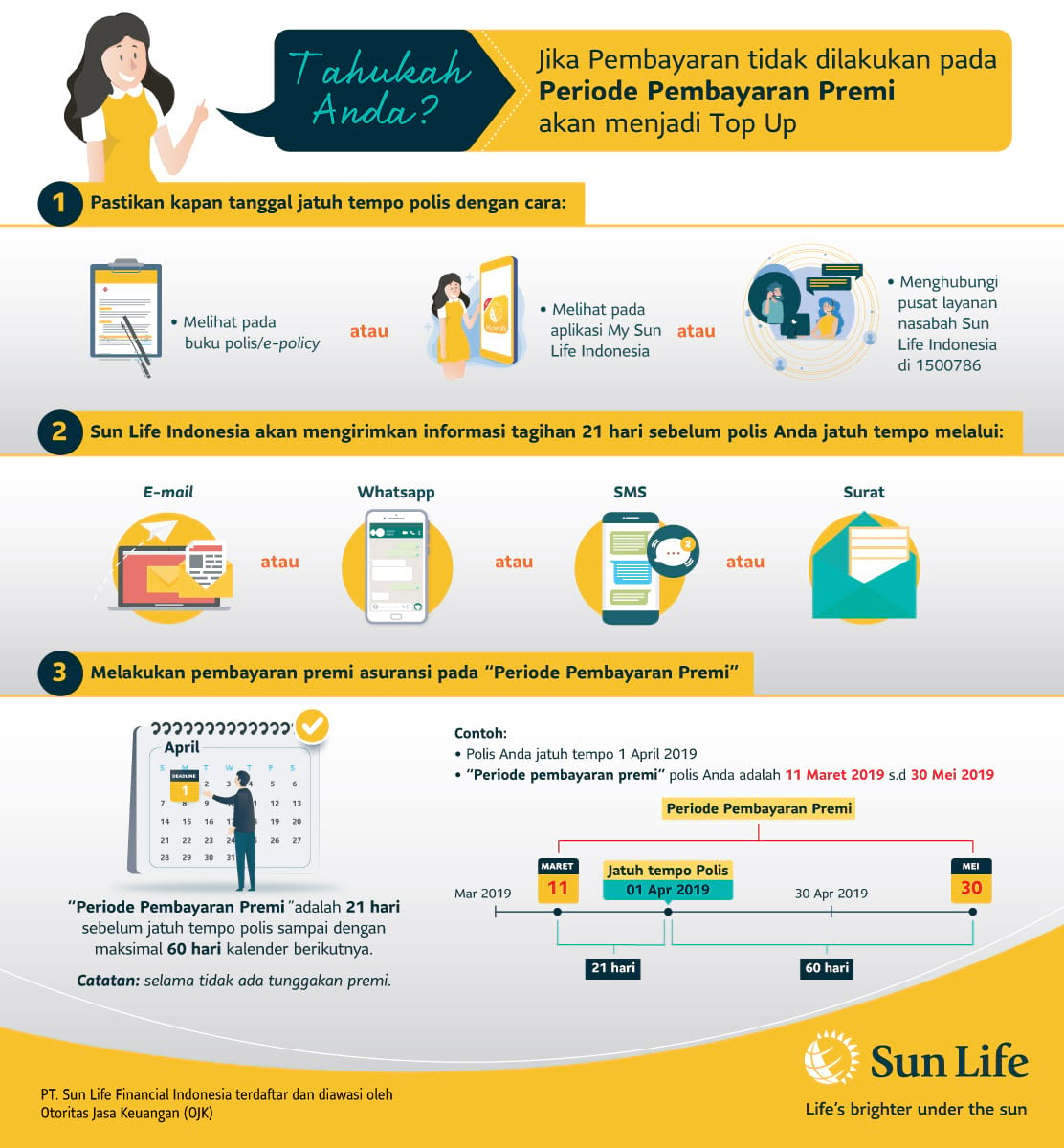

7. How not to make your premium payment as Top Up?

Purchasing the product through bank and other channels

Premium payment can be done through:

1. Bank Teller

| Bank | Beneficiary Name | Beneficiary Account |

|---|---|---|

| CIMB Niaga teller | Policyholder’s name | 5429 + 9 digits of policy number |

2. ATM

Go to “Transfer” menu in the ATM

Bank |

Beneficiary Account |

|---|---|

CIMB Niaga |

5429 + 9 digits of policy number |

Other banks (non-bank partner) |

022 + 5429 + 9 digits of policy number |

3. Internet Banking

Go to “Transfer” menu

Bank |

Beneficiary Name |

Beneficiary Account |

|---|---|---|

CIMB Niaga |

Policyholder’s name |

5429 + 9 digits of policy number |

Notes:

4. Pembayaran khusus Polis Asuransi mata uang Dollar

| Nama Bank | Nomor Rekening | Nama Pemilik Rekening |

| CIMB Niaga | 801-667777-040 | PT Sun Life Financial Indonesia |

5. Multiple payment

Multiple payment is an option for clients who have been using auto debit since the beginning, but experiencing obstacles:

In order to maintain the validity of policy, clients can pay the overdue premium via transfer to Virtual Account number.

6. How not to make your premium payment as Top Up?

© 2020 Sun Life Indonesia. All rights reserved. PT Sun Life Financial Indonesia is licensed and supervised by Otoritas Jasa Keuangan (OJK)

Menara Sun Life Lantai Dasar, Jl Dr Ide Anak Agung Gde Agung Blok 6.3, Kawasan Mega Kuningan - Jakarta Selatan 12950